A Real Estate Agent Helps Take the Fear Out of the Market

Do negative headlines and talk on social media have you feeling worried about the housing market? Maybe you’ve even seen or heard something lately that scares you and makes you wonder if you should still buy or sell a home right now.

Regrettably, when news in the media isn’t easy to understand, it can make people feel scared and unsure. Similarly, negative talk on social media spreads fast and creates fear. As Jason Lewris, Co-Founder and Chief Data Officer at Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

But it doesn’t have to be that way. Buying a home is a big decision, and it should be one you feel confident making. You should lean on a trusted real estate agent to help you separate fact from fiction and get the answers you need.

That agent will use their knowledge of what’s really happening with home prices, housing supply, expert forecasts, and more to give you the best possible advice. The National Association of Realtors (NAR) explains:

“. . . agents combat uncertainty and fear with a combination of historical perspective, training and facts.”

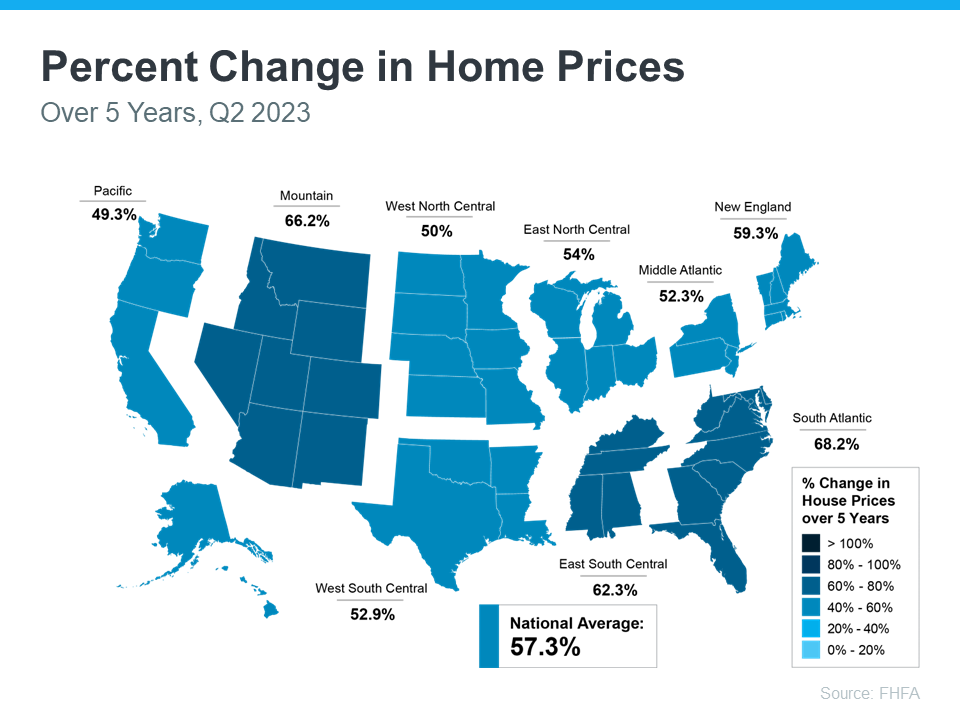

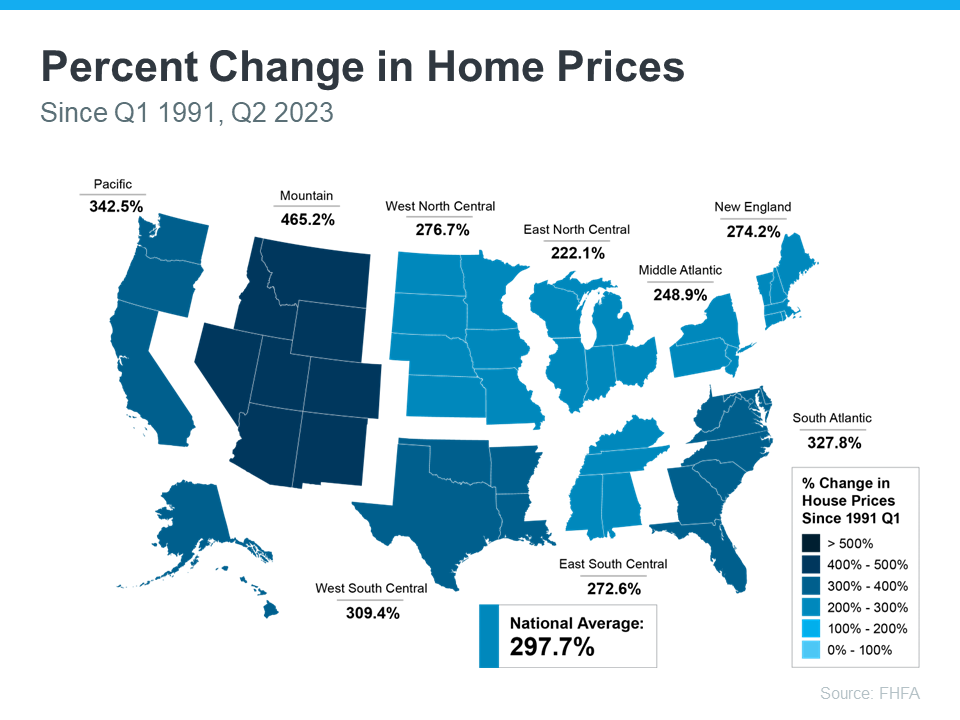

The right agent will help you figure out what’s going on at the national level and in your local area.

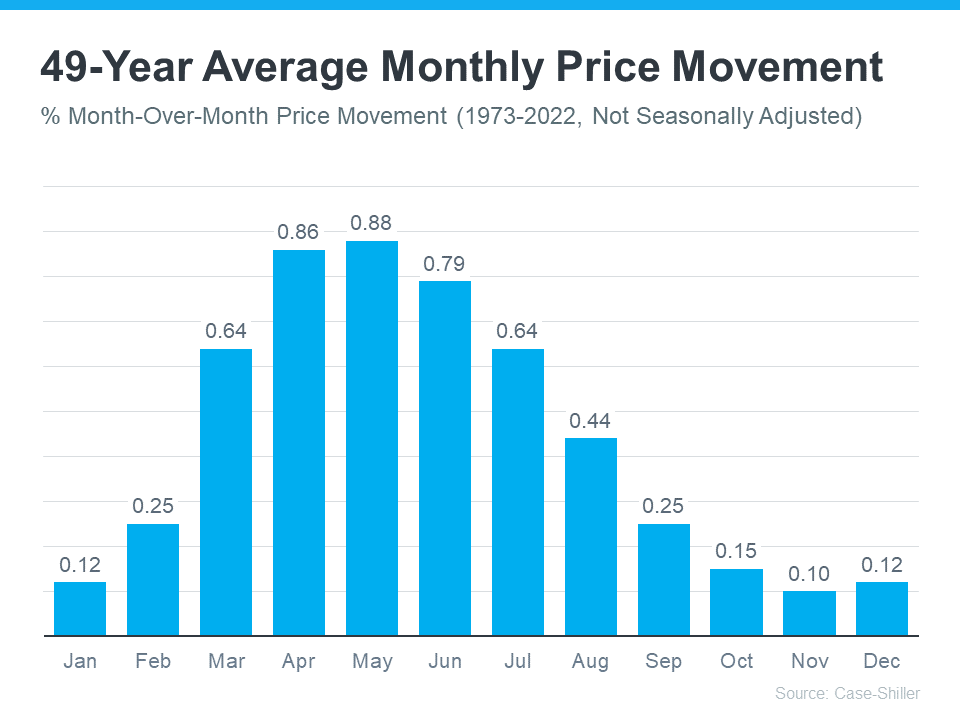

They’ll debunk headlines using data you can trust. Plus, they have in-depth knowledge of the industry and can provide context, so you know how current trends compare to the normal ebbs and flows in the housing market, historical data, and more.

Then, to make sure you have the full picture, an agent can tell you if your local area is following the national trend or if they’re seeing something different in your market. Together, you can use all that information to make the best possible decision.

After all, making a move is a potentially life-changing milestone. It should be something you feel ready for and excited about. And that’s where a trusted expert comes in.

Bottom Line

If you need reliable information about the housing market and expert advice about your own move, let’s connect.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link